Think about the recent cultural highs that ignite excitement, from unboxing festive gifts, to shopping splurges, to electrifying conversations with fans surrounding the sporting events. Where was the buzz? Not just on TV. The real-time excitement—memes, reactions, influencer banter, video tutorials, product plugs, live commentary—is all happening on a variety of social media platforms. This is the new stadium. It’s where your consumers are watching, reacting, talking, and buying—all at once. Multi-screen is the new norm. Consumers today aren’t just passively watching ads; they’re steering the entire buying journey with a second screen. Maybe it’s a reel, a short-form product ad, or a positive reaction to a limited-time sale. This multi-screen behaviour has become the dominant pattern, and brands that aren’t optimizing for that moment are leaving impact and revenue on the table. According to a report, Southeast Asia is a hotspot for online video consumption, with 70.4% of online users active on social media. Users spend about four days a week on new product discovery, playing video games, and streaming shows.

Social Optimization: Safety, Suitability & Conversions

The brand lives between selfies, posts, and stories. Therefore, measuring the impact of campaigns on real people is more important than ever for brands, making social optimization crucial to bring about transparency and maximize every interaction between the brand and its consumers. A report states that Thailand leads the world in weekly online purchases, with 66.6% of internet users shopping online, followed closely by the Philippines (59.7%), Malaysia (59.6%), Vietnam (59%), and Indonesia (56%).

As budgets shift to social media, advertisers call for brand-suitable solutions and transparency to spend and measure their campaigns effectively. Along with identifying the most attention-rich placements across social platforms, advertisers want the ability to avoid risky or unsuitable environments. Most importantly, leveraging real-time insights to dynamically allocate the budget toward high-performing ads while suppressing low performers, thereby driving both efficiency and impact in social media campaigns.

Social optimization is a powerful tool for reducing digital waste, enhancing campaign effectiveness, and maximizing the return on ad spend. Advertisers can ensure brand safety and suitability on social media platforms by using measurement and optimization tools to prevent ads from being placed next to harmful or inappropriate content. One of the case studies we saw was by Vinda, who aimed to optimize their media spending and improve the effectiveness of its advertising campaigns on Meta platforms. Leveraging IAS’s AI-powered solutions, Vinda ensured that their campaigns appeared in brand-suitable environments, resulting in a 2.03% increase in video view rate, a 34% rise in conversion rate, and a 1.11% improvement in viewability.

How Does Attention Drive Performance on Social Platforms?

Attention measurement extends beyond traditional metrics, such as impressions and clicks, to accurately gauge how consumers interact with ads. On social platforms, attention is the critical driver of performance. In environments where content scrolls endlessly and distractions are constant, capturing and sustaining attention is what transforms passive exposure into meaningful engagement and real business outcomes.

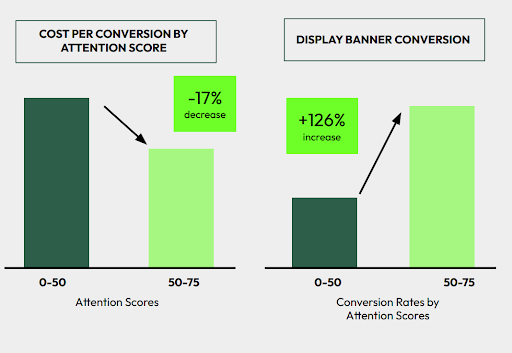

In partnership with Dentsu, Integral Ad Science (IAS) conducted a study for Standard Chartered Bank (SCB) to examine the impact of attention scores in influencing campaign outcomes across display ad formats. The results showed that SCB attained an attention score 59, outperforming the global coverage across all placement types. Notably, in-app tablet and mobile inventory reached an impressive attention score 89. By optimizing towards high-attention environments, SCB improved cost efficiencies and drove higher conversions.

Social media has emerged as a powerful channel for product discovery and purchase, with 70% of consumers preferring to shop via smartphones. This shift is particularly pronounced during culturally significant events such as Ramadan, the Singapore Grand Prix, etc. As social, commerce, and community continue to converge, brands have a unique opportunity to deliver live, localised, and culturally impactful shopping experiences. The social commerce market in APAC is anticipated to grow at a CAGR of 10.6% between 2022 and 2028, reaching $894mn by 2028. Reviews from influencers, interactive formats such as polls and live streaming, and video tutorials are instrumental in catering to today’s digitally native audience that prioritises speed, convenience, and trust.

As platform trends continue to unfold, advertisers require advanced measurement and optimization solutions to effectively spend, engage, and measure performance on social media platforms, striking a balance between equity and performance.