Market Overview: Indonesia’s Evolving F&B Landscape

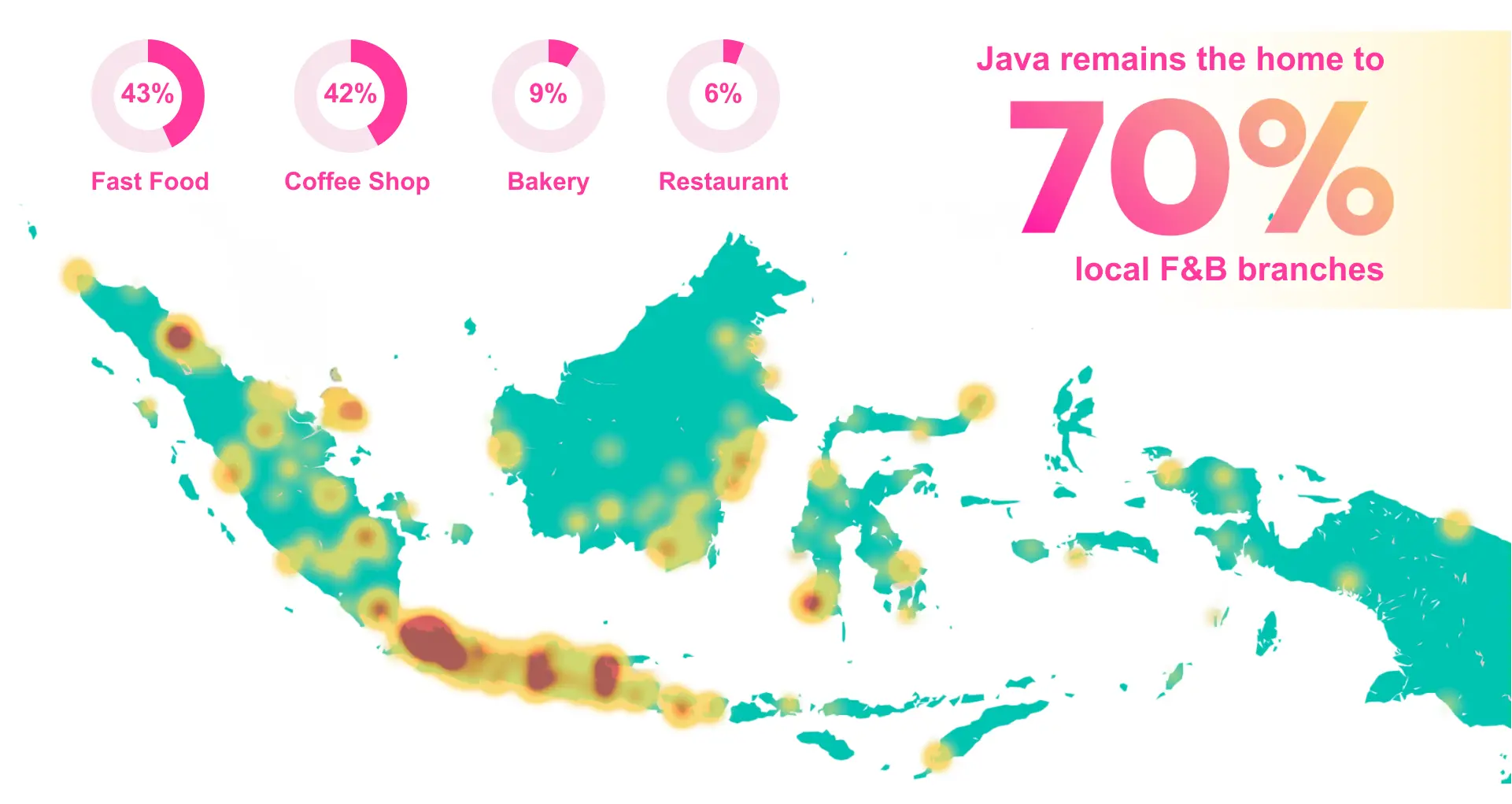

Fig. I: Indonesian Local F&B Branches Distribution[1]

Indonesia, famous for its rich culture and delicious food, is seeing big changes in its food and drink industry. More and more, local food and beverage (F&B) brands are winning the hearts and loyalty of Indonesian consumers. This analysis looks at how these local businesses are growing and what consumer behaviors are driving their success.

The Indonesian F&B market is lively, supported by a growing middle class, more disposable income, and a rising desire for diverse food experiences. While international brands have traditionally dominated, local entrepreneurs are now making a strong impact. They use authenticity, innovation, and cultural connections to create attractive F&B offerings. Java Island leads Indonesia’s local F&B industry, highlighting its key role in this growth. Fast Food and Coffee Shops are the most common, making up 43% and 42% of the branches, respectively (See Fig. I). These percentages indicate the distribution of F&B categories among popular local brands sampled.

Consumer Engagement: A Closer Look at Visit Patterns

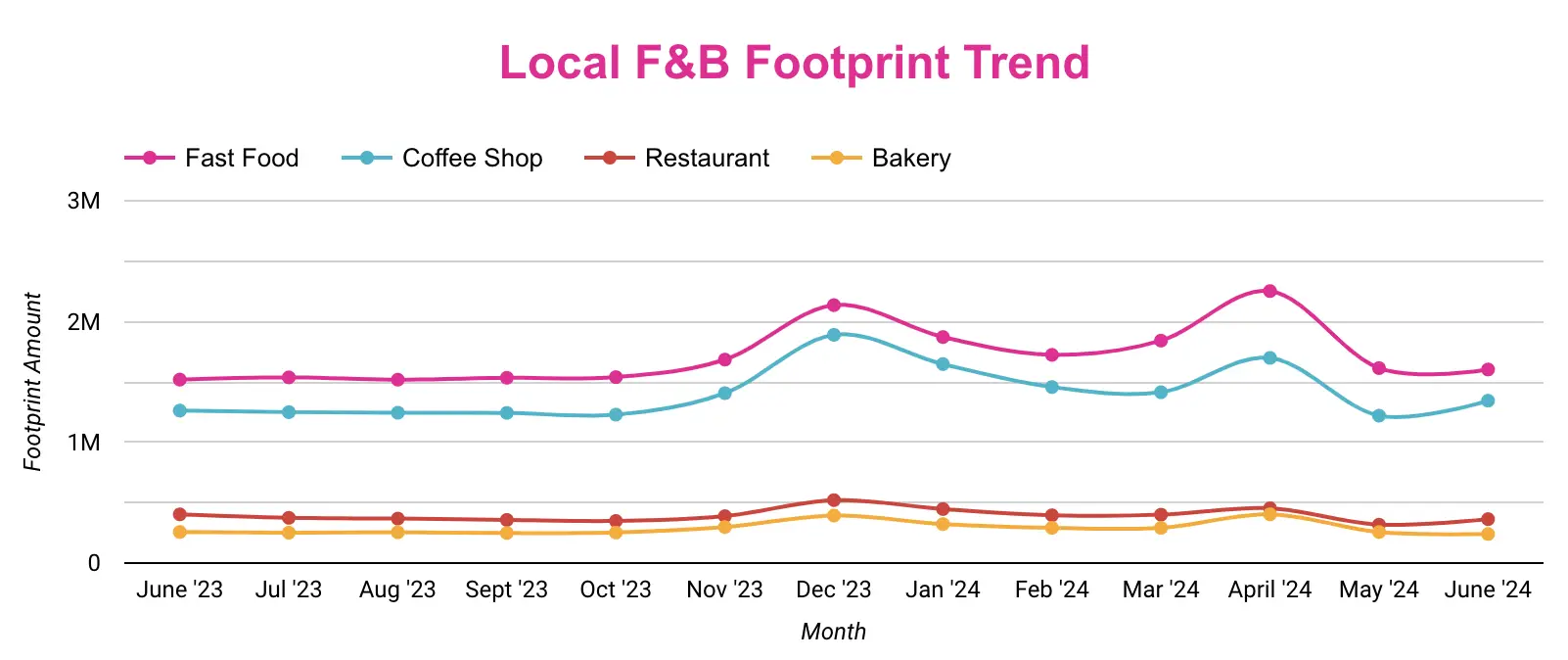

Graph I: One Year Local F&B Footprint Trend2

According to the above line graph, a massive rise in local food and drink businesses, especially in Fast Food and Coffee Shops, from November 2023 to April 2024. During this time, the number of visits to Fast Food places almost hit 2.5 million, and visits to Coffee Shops also grew steadily. This increase shows that more people are interested in these local food options, likely because of seasonal factors and successful promotions.

In contrast, Restaurants and Bakeries exhibited more consistent visitation patterns. However, their customer visits gradually increased from March to June 2024, suggesting a loyal customer base. Overall, the rising visitation rates to all types of local food and drink businesses indicate their growing popularity as more people opt to dine locally.

Regional Trends: The Shift to Local Brands

From June 2023 to June 2024, over 1.28 million Indosat Ooredoo Hutchison users— or 10.30%—switched from international brands to local ones[2].

This significant increase, which began in January 2024, demonstrates a strong trend toward supporting local businesses and enjoying community-made products. As more local brands have popped up, the regular folks prefer local brands because they offer great flavors at more affordable prices compared to international brands.

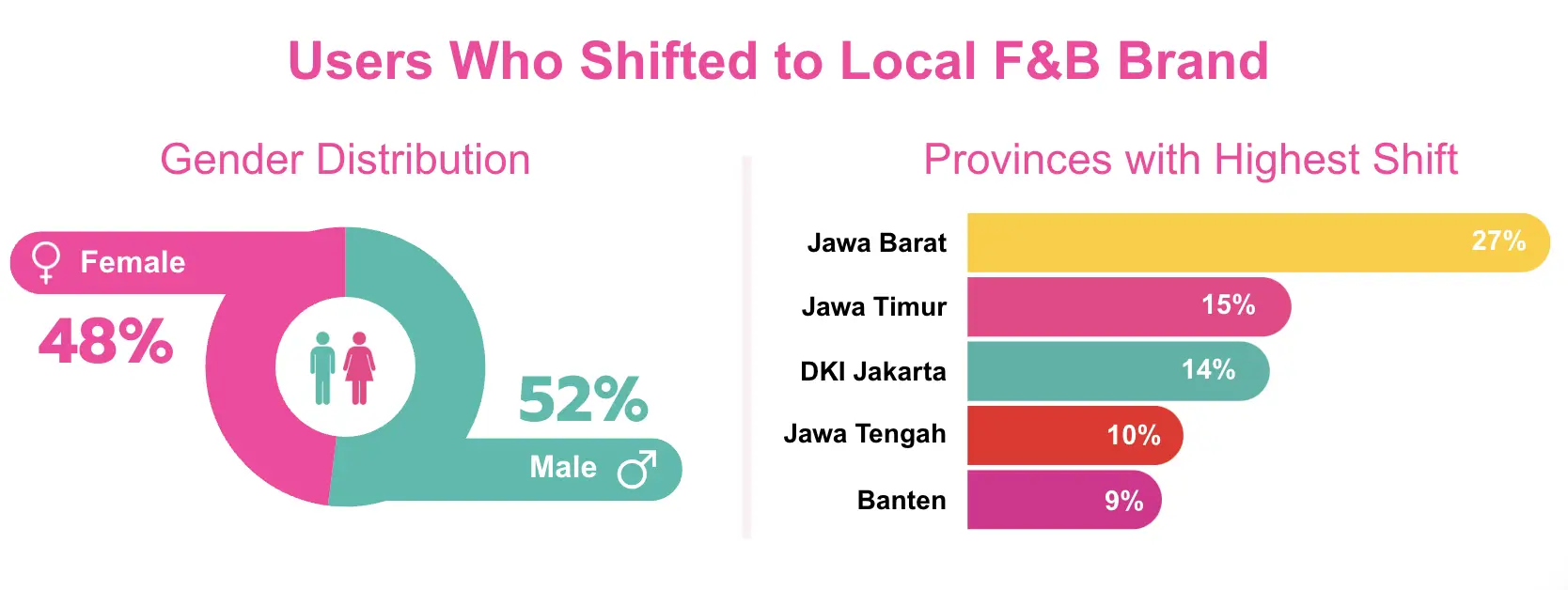

Chart I: Users Segmentation Who Shifted to Local F&B Brand[3]

Out of the 1.28 million users who switched to local brands, Jawa Barat (Translate: West Java) stands out with the biggest share, making up 27% of the total shift. This indicates that approximately 350,000 users in West Java have made the change, making it the leading province in this trend. Within Jawa Barat, the shift to local brands is led by key cities like Kabupaten Bogor, Kota Bekasi, Kota Jakarta Timur, Kabupaten Bekasi, and Kota Surabaya.

Analyzing the age groups of the users making the switch is essential for understanding the regional trends, providing valuable insights into evolving consumer habits, and enabling us to develop effective strategies for engaging with various age groups.

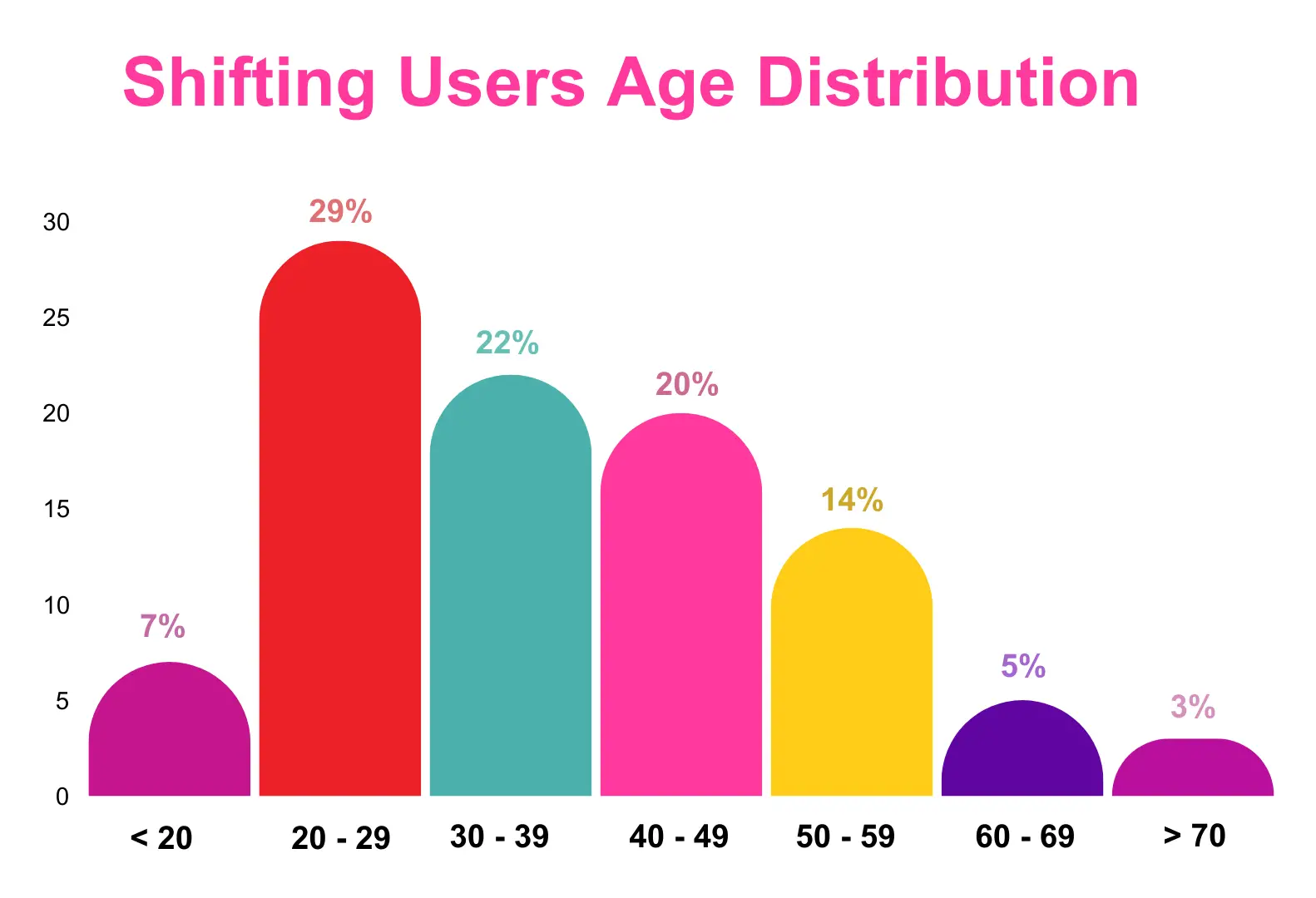

Chart II: Shifting Users Age Distribution3

The shift to local brands is mainly driven by younger consumers, with the 20-29 age group leading the way. They represent the largest portion of users making the switch. The 30-39 age group also shows strong support for local brands. Middle-aged consumers in the 40 – 49 range also contribute to the shift.

However, fewer users from the Under 20, 50 – 59, 60 – 69, and Upper 70 age groups are making the switch. This demographic-based trend highlights that young adults or ‘The Millenials’ are at the forefront of this change, offering a key opportunity for targeted marketing strategies.

Socioeconomic Factors: The Role of SES in Consumer Behavior

To gain a deeper understanding of these trends, it’s important to examine how different socioeconomic status (SES) levels relate to these age groups. Exploring SES levels within each age group will help us to create strategies that effectively target different customer segments. Understanding the economic and social factors behind the shift to local brands is key to this process.

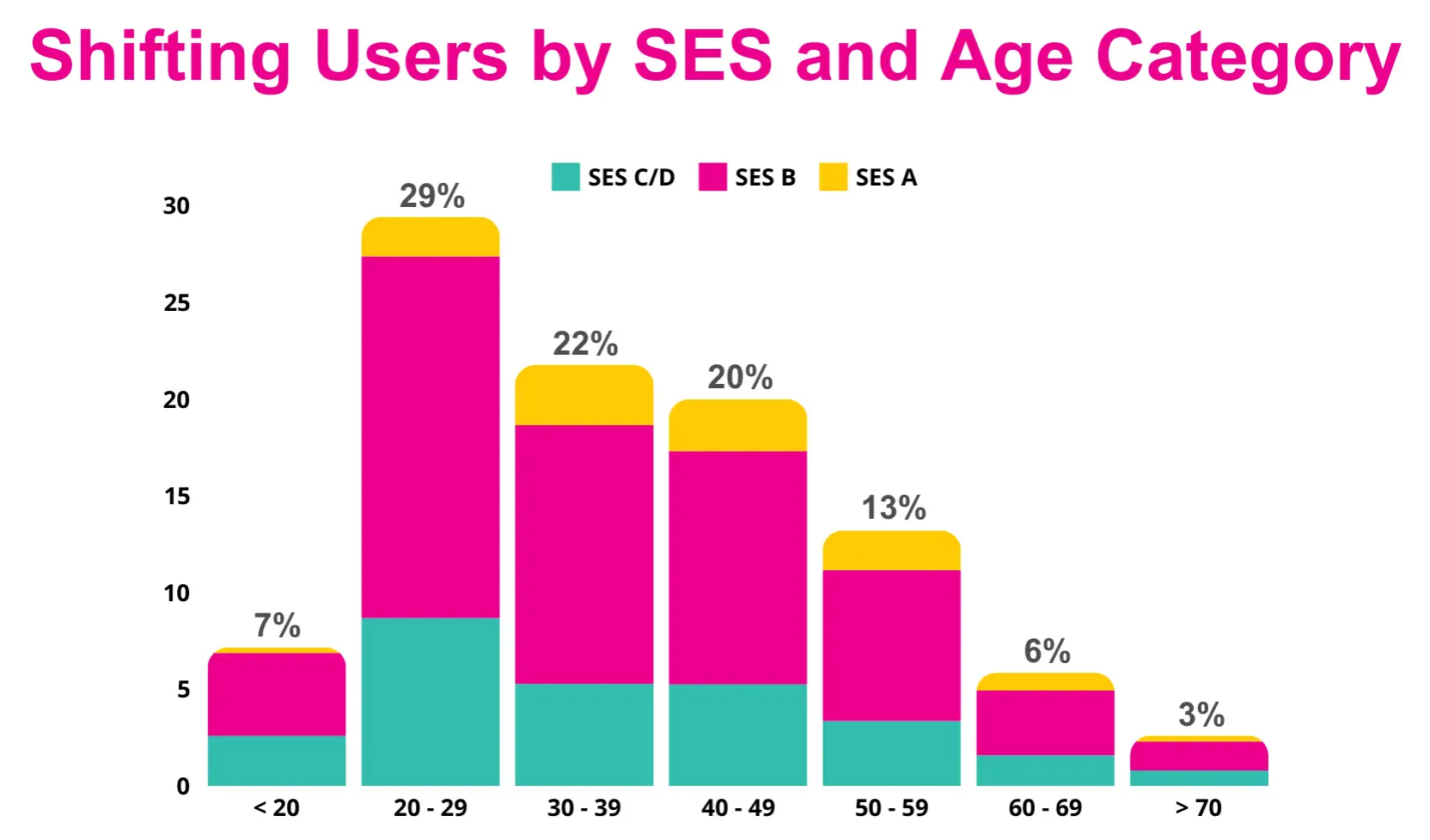

Chart III: Shifting users by SES and age category[4]

The data reveals that SES B accounts for the highest number of users shifting to local brands, indicating a strong preference among this group. SES C/D follows by showing a notable but smaller shift. SES A reflecting a smaller segment of the shift. This distribution highlights that while the shift is widespread, it is particularly pronounced among the middle and lower SES levels, providing key insights for targeting marketing efforts effectively.

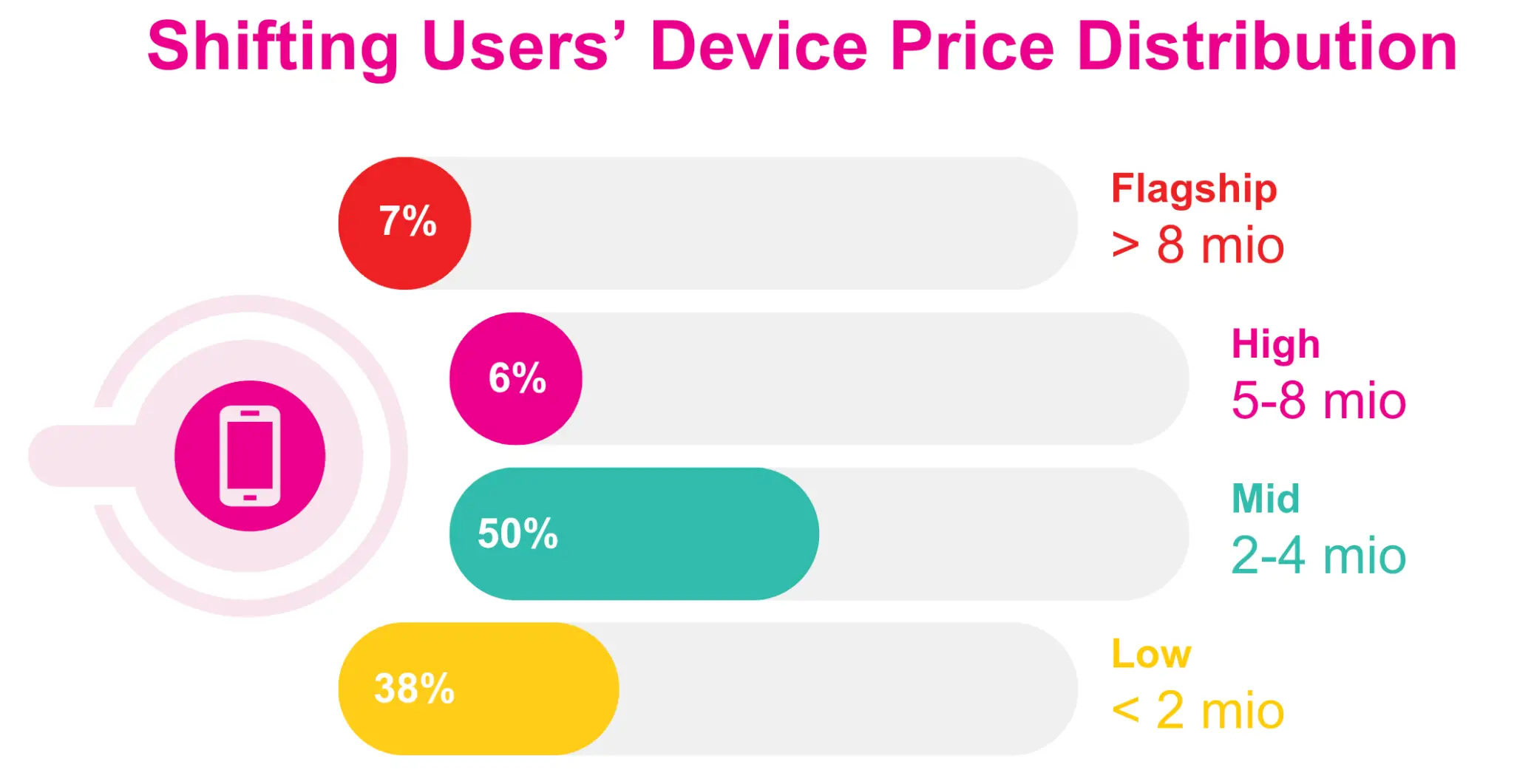

Chart IV: Shifting user’s device price distribution[5]

The chart above reveals an interesting correlation between device price and the propensity to shift towards local F&B products. Users in the lower to mid-tier device price ranges, comprising a substantial 88% of the total, demonstrate a higher inclination to embrace local F&B offerings. Specifically, the “mid” price range (2-4 million IDR) dominates with 50% of users, followed closely by the “low” price range (under 2 million IDR) at 38%. Conversely, users with high-end devices, both in the “high” (5-8 million IDR) and “flagship” (>8 million IDR) categories, represent a smaller segment of only 13%, suggesting a potentially different consumption pattern.

The Importance of Personalized Marketing

The growth of local F&B brands in Indonesia is a testament to the country’s evolving consumer landscape. As younger tech-savvy consumers increasingly favor local over international brands, the importance of understanding and catering to this demographic cannot be overstated. By leveraging insights into consumer behavior, socioeconomic factors, and technological preferences, local brands can continue to thrive in Indonesia’s competitive F&B market. Therefore, personalized marketing emerges as a critical strategy for maximizing the potential of this growing industry. By leveraging data on age, SES, device usage, and purchase behavior, brands can create tailored marketing campaigns that resonate with specific consumer segments. Personalized marketing involves delivering targeted messages and offers based on individual preferences and behaviors. This implies sending the right message to the right person at the right time.Whether through social media, email, or apps, businesses can share information that customers care about. Providing relevant and personalized content can help local F&B brands to build stronger customer relationships, increase loyalty, and drive sales.

The growth of local F&B brands in Indonesia is a testament to the country’s evolving consumer landscape. As younger tech-savvy consumers increasingly favor local over international brands, the importance of understanding and catering to this demographic cannot be overstated. By leveraging insights into consumer behavior, socioeconomic factors, and technological preferences, local brands can continue to thrive in Indonesia’s competitive F&B market. Therefore, personalized marketing emerges as a critical strategy for maximizing the potential of this growing industry. By leveraging data on age, SES, device usage, and purchase behavior, brands can create tailored marketing campaigns that resonate with specific consumer segments. Personalized marketing involves delivering targeted messages and offers based on individual preferences and behaviors. This implies sending the right message to the right person at the right time.Whether through social media, email, or apps, businesses can share information that customers care about. Providing relevant and personalized content can help local F&B brands to build stronger customer relationships, increase loyalty, and drive sales.

[1] Data source: IOH Big Data

[2] Ibid.

[3] Ibid.

[4] Ibid.

[5] Ibid.