The insurance industry in Indonesia recorded growth in the first quarter of 2024. According to data released by the Indonesian Life Insurance Association (AAJI) in its first-quarter performance report, total revenue grew by 11.7%, with premium revenue showing a slight increase of 0.9%.[1]

This growth boosts optimism for the life insurance industry this year, despite the challenges posed by medical inflation and rising health claims. In fact, in 2023, AAJI recorded a 25% increase in health claims, with the health insurance claim ratio to premium revenue for that product reaching 138%.[2]

This data highlights the current high level of national medical inflation, which is predicted to rise further to 13% in 2024, exceeding the average medical inflation rate in Asia.[3] The impact of this medical inflation includes rising healthcare facility costs, hospital fees, and pharmaceutical expenses. These factors force insurance companies to adjust the costs or premiums of health insurance products to ensure that policyholders continue to receive optimal healthcare protection.

This situation is certainly a concern for health insurance policyholders, as they may wonder whether it will affect the premiums they pay, given that medical inflation is expected to occur annually. In the wake of a recovering economy post-pandemic, Indonesian families will have different priorities, including insurance protection. Therefore, when insurance companies adjust their insurance costs or premiums, it could be a factor that influences customers to either continue with or terminate their existing policies.

Collective Efforts through #SehatPangkalBisa

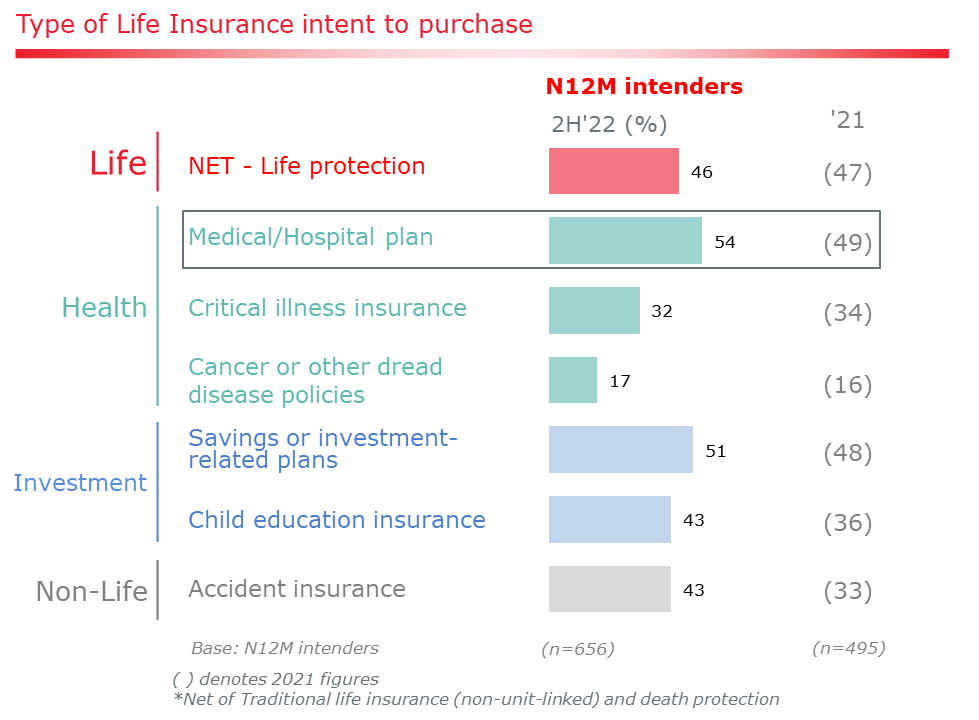

The Covid-19 pandemic has driven a shift in people’s lifestyles, with many starting to adopt healthier habits, such as exercising regularly and consuming nutritious food. At the same time, the pandemic has also raised public awareness about the importance of protection, particularly health protection. This was reflected in a tracking survey conducted by Prudential in 2022, which showed an increase in the number of people planning to acquire medical or hospital insurance after the pandemic.

Picture 1: Type of insurance intent to purchase, Prudential internal data.

However, the pandemic also triggered medical inflation, which led to higher prices for medical supplies and delayed medical treatments, contributing to a rise in health insurance claims.

This has been viewed as an opportunity to continue fostering the healthy lifestyles that people have begun adopting and simultaneously grow the health insurance business by offering products tailored to these lifestyles.

Prevention is better than cure, and Prudential continuously encourage people to maintain their health through the #SehatPangkalBisa campaign, which is rooted in customer insights. In Q4 2023, we conducted a Focus Group Discussion with both Prudential policyholders and non-policyholders aged 25–60 (from Gen Z, Millennials, to Golden Age) to gather perceptions on the importance of staying healthy. The responses were clear: when we are healthy, we can do anything.

Thus, health is understood as a state of complete physical, mental, and social well-being, not just the absence of disease. With this basis, Prudential launched the #SehatPangkalBisa campaign to continue promoting healthy living.

Prudential Encourage Healthy Lifestyle

Prudential translates the spirit of #SehatPangkalBisa through various initiatives aimed at addressing challenges in the life insurance industry while also introducing a customer-oriented product that rewards healthy lifestyles: PRUWell a reward or incentive for policyholders who make no claims, in the form of premium discounts for the following year. These discounts increase the longer the policyholder maintains their health, with a maximum discount of up to 20% to provide both financial stability and emotional benefits, offering peace of mind.

In addition, Prudential initiated a movement that encourages an active lifestyle through community-based exercise called PRUActive Community,that promotes healthy living and maintaining an ideal body weight through the “10 Weeks Fit and Well Challenge,” where participants can track their health progress as they engage in various community activities.

Information about the PRUActive Community is promoted through social media (Instagram, Facebook), both organically and via paid ads, as well as on Prudential’s website and its partners’ sites. The campaign also receives support from sports communities and coaches, who share posts on their personal and community social media pages. Participants themselves contribute to raising awareness by posting about the sessions on Instagram and TikTok.

There are three metrics used to assess participants: first, consistency (attending PRUActive events at least three times within two weeks); second, improvement (demonstrating progress in fitness, measured by BMI); and third metric is advocacy. Throughout the challenge, participants’ health progress is monitored by fitness experts, and they receive health consultations, in collaboration with Prudential’s hospital partners.

With these three measurements, Prudential has successfully encouraged participants to promote a healthy lifestyle.[4]

- Participants were mostly from younger age groups, with 57% aged 20–29 and 34% aged 30–39, the core target for this campaign.

- 11% of participants consistently attended at least three class sessions within two weeks.6% of participants in the “Improvement Challenge” showed measurable improvements in fitness over the 10-week period.

- 8% advocated within their circles by sharing their experiences on social media.

- Prudential is perceived as being strong in “caring about making communities better” and “promoting activities that help people lead healthier lives.”

During the 10-week implementation from May to July 2024, the PRUActive Community program exceeded its target by reaching 7,067 participants in the Greater Jakarta area (Jakarta, Bogor, Depok, Tangerang, and Bekasi). These participants joined over 250 sports classes, both in community sessions and exclusive studios across various cities in the region, offering activities such as POUND, dance, yoga, Pilates reformer, and many more. This initiative not only introduced sports enthusiasts to Prudential but also increased their interest in exploring health insurance products through sales forces.

The #SehatPangkalBisa movement was not limited to offline activities but was also promoted extensively across various social media platforms.

- Through organic and paid activation on social media, the campaign reached more than 6 million people, with 3.9 million engagements.

- Organic campaigns to raise awareness on Prudential’s official social media channels included interactive activities such as “add yours,” quizzes, and the use of hashtags.

- Awareness was boosted through paid meta-ads, Google, and publishers to promote healthy living.

- Consideration for the product was built through Google, Meta, and key opinion leaders (KOLs), targeting those who interacted with the awareness ads about the product benefits.

- Conversion was driven via Google and publishers using personalized benefit hard-sell ads, featuring lead forms for those interacting with product ads to leave their details for follow-up.

- In addition to social media, the #SehatPangkalBisa campaign was also highlighted through media engagement activities such as Chief Editor Gatherings, Press Conferences, Radio Talk Shows, Media Gatherings, and Press Releases, generating a PR Value of over IDR 10 billion during the campaign period, thus dominating discussions on medical inflation by providing tangible solutions for the community.

Moreover, Prudential also conducted customer outreach through its #SehatPangkalBisa campaign presented through customer gatherings in six major cities and personalized video messages aimed at encouraging customers to appreciate healthy living and informing them of the benefits available to them as Prudential policyholders. These personalized videos were sent to over 200,000 customers, accompanied by invitations to join the PRUWell product, achieving a conversion rate of 9%, far surpassing the control group’s 3.5%.

Picture 2. Personalized video message, Prudential internal data.

With the #SehatPangkalBisa spirit, Prudential continues to expand its partnerships with hospital networks, PRUPriority Hospitals, which provide transparent services following clinical pathways to prevent overcharging and overtreatment for Prudential patients. More than 300 hospitals in over 100 cities and regions, both domestically and internationally, have joined the PRUPriority Hospitals program, and the network will continue to grow.

The Positive Impact of the #SehatPangkalBisa Campaign in Ensuring Balance in the Health Protection System

Since the launch of the #SehatPangkalBisa campaign in April 2024, coinciding with the release of the PRUWell product, Prudential recorded its highest PRUWell sales in June, reaching its premium targets, particularly in the health insurance category, within the first three months of the launch. By July, 70% of premiums from new business were contributed solely by PRUWell, demonstrating that it is a well-targeted product, supported by an effective marketing campaign.

Another interesting fact is that with the #SehatPangkalBisa spirit embedded in PRUWell:

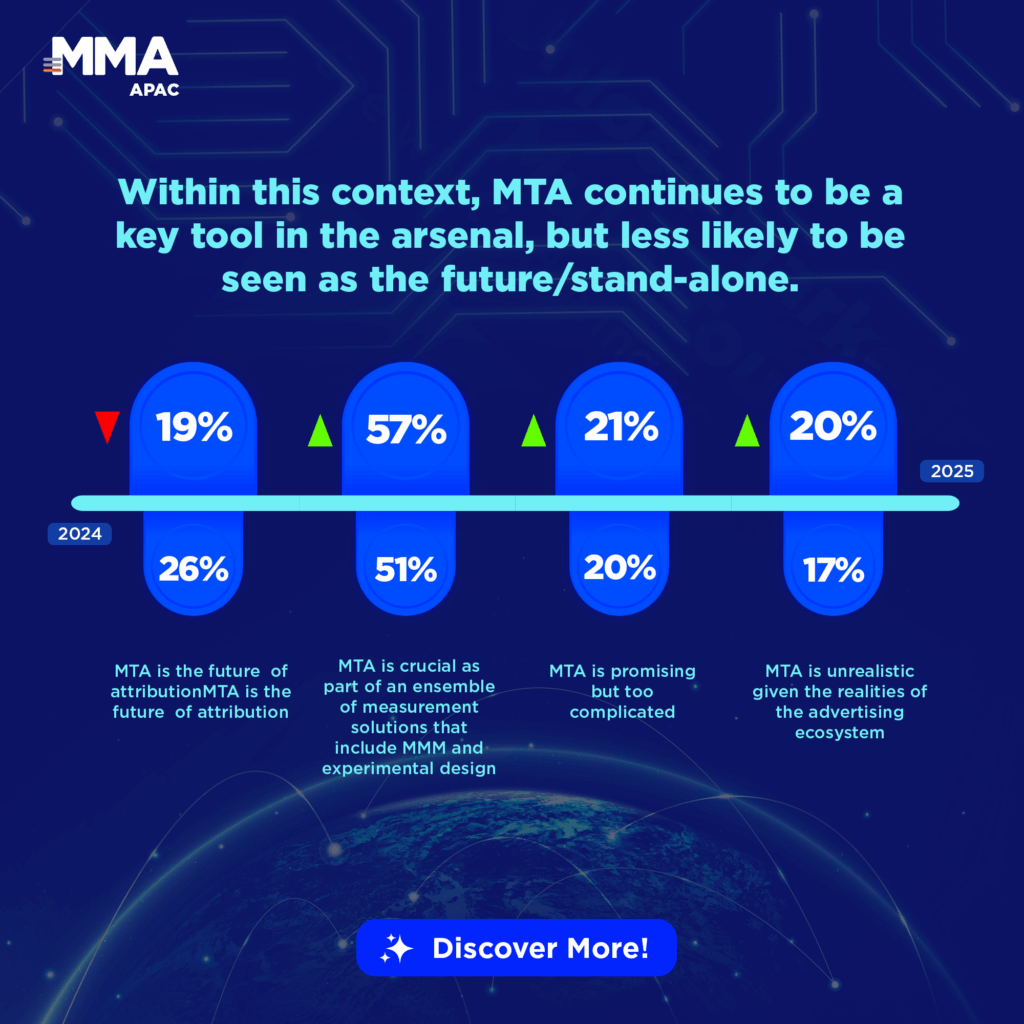

- The product successfully attracted existing Prudential customers with older health insurance policies to switch to PRUWell, achieving a conversion rate of nearly 10% within the first three months of the campaign.

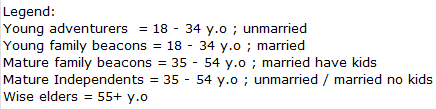

- It also captured the interest of younger generations in insurance, with 21% of new policyholders coming from the Young Generation segment (18–34 years old; unmarried) and 25% from the Young Family segment (newly married under 35 years old).

Picture 3: New Policyholders of PruWell as per Jul 2024 by segment, Prudential internal data.

The #SehatPangkalBisa campaign has positioned PRUWell as a pioneer in a new health insurance concept, and strengthened Prudential’s position as a trusted partner and protector for its customers and the Indonesian community, offering protection for this generation and generation to come.

[1] Asosiasi Asuransi Jiwa Indonesia, “Sinyal Positif Pertumbuhan Asuransi Jiwa di Awal Tahun 2024”, Press Release, Mei 29, 2024.

[2] Ibid., “Klaim Asuransi Kesehatan Terus Meningkat, Industri Asuransi Jiwa Terus Meningkat”, Press Release, February 27, 2024.

[3] Mercer Marsh Benefits (MMB), Health Trends 2024, November 18, 2023.

[4] Prudential PruActive Community Event Evaluation