In financial services, performance marketing often takes the spotlight. Banks spend heavily on acquisition campaigns, optimizing conversion funnels and chasing cost-per-account targets. Brand campaigns, by contrast, are too often dismissed as soft investments that build reputation but not revenue. New findings from the Brand as Performance (BaP) initiative flip that assumption on its head. The evidence from Ally Bank shows that brand isn’t just reputation — it’s a measurable driver of growth that compounds over time.

Favorability converts into real accounts

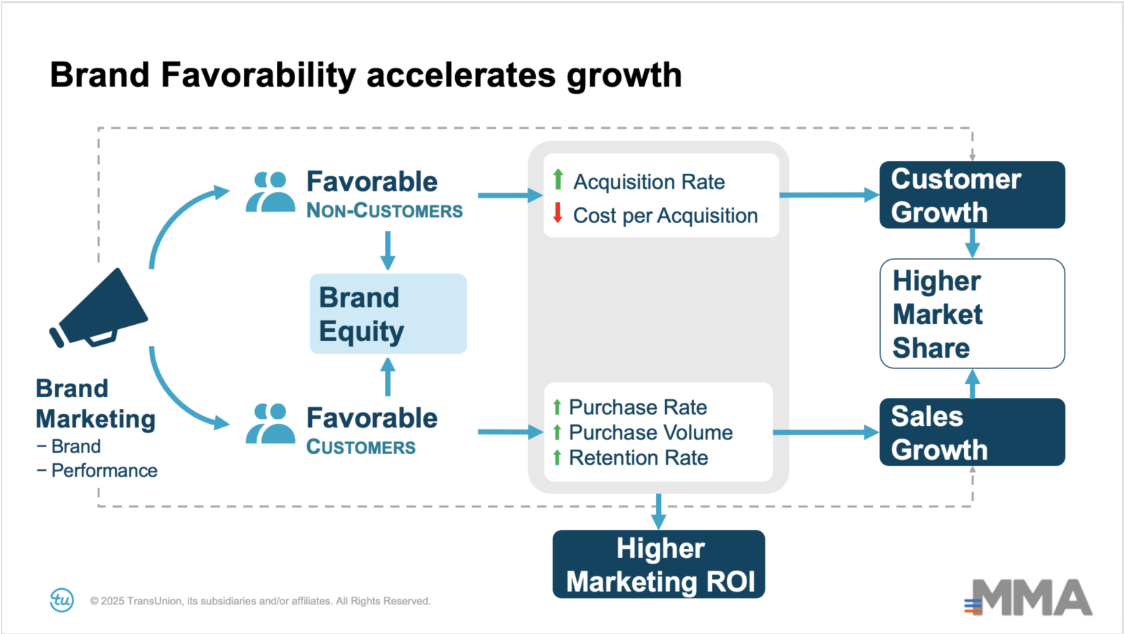

The BaP research demonstrates a consistent truth: consumers who feel favorable toward a brand are far more likely to act. For Ally Bank, the difference was dramatic. Favorables opened six times more accounts per household compared to non-favorables. This isn’t an incremental lift. It’s proof that building positive brand sentiment directly fuels customer acquisition.

The long tail of impact

Perhaps the most surprising finding is when the sales lift occurred. Traditional reporting windows measure results only while ads are running. Ally’s case shows why that approach misses the bigger picture. More than 80 percent of the sales lift came in the seven months after the campaign ended.

Advertising didn’t just drive immediate account openings. It continued working silently in the background, moving favorable consumers closer to action long after the media spend had stopped. The value of brand advertising doesn’t vanish at campaign’s end — it compounds.

What this means for banking marketers

For an industry under constant pressure to prove ROI, Ally’s case study offers three lessons:

- Brand drives acquisition efficiency. Favorability is not a vanity metric; it’s a predictor of conversion.

- Short-term windows underestimate ROI. True advertising value unfolds over months, not just weeks.

- Retention and growth follow favorability. Favorable customers are more likely to stay, purchase more, and expand their relationship with the bank.

Broader implications for marketers

While Ally represents the banking sector, similar results have emerged across food, retail, and telecom studies. Favorables consistently convert at higher rates, deliver more value, and stay longer. The compounding effect of brand is not an isolated story — it’s a universal growth dynamic.

Closing thought

Ally Bank’s results make one thing clear: brand isn’t a side investment, it’s a growth engine. By building favorability, advertising not only drives conversions today but multiplies returns in the months that follow. For marketers under pressure to deliver both short- and long-term ROI, the lesson is simple. Bank on brand — because brand pays back.