For decades, brand tracking has been ruled by methodical, structured surveys. But what if we told you that some of the most powerful brand signals don’t come from trackers, but from consumers?

We’re talking about user-generated content (UGC): memes, rants, reviews, TikTok videos (and more) that shape how people experience your brand in real life. If you’re not treating this social signal as a core brand metric, you’re missing out on a fundamental shift in how brand equity is being built today.

Survey research remains invaluable, but it provides only part of the picture. To truly understand today’s brand dynamics, we need to look at the conversations happening organically.

Social media: a reflection of brand reality

There’s a clear link between social media conversations and traditional brand health metrics like awareness, consideration, preference, and even emerging relationships with in-market data like sales and units sold.

These aren’t just anecdotes or gut feelings; they’re markers of brand perception. We’ve seen it across categories and cases:

1.How sentiment moves toothpaste stocks

In our analysis for a leading toothpaste brand, we found that social media sentiment has a clear, lasting impact on stock prices. Positive sentiment consistently aligned with upward movements in stock, demonstrating that what consumers say online translates into real business value.

The effect doesn’t disappear quickly. Momentum builds over time, making sentiment a reliable input for forecasting and showcasing how social listening can directly inform financial strategy.

2. Sweet talk pays off

In the chocolate space, positive social sentiment is linked to higher mental market share and broader network size. The tone of online conversation matters: joyful, emotionally rich talk translates directly into brand salience.

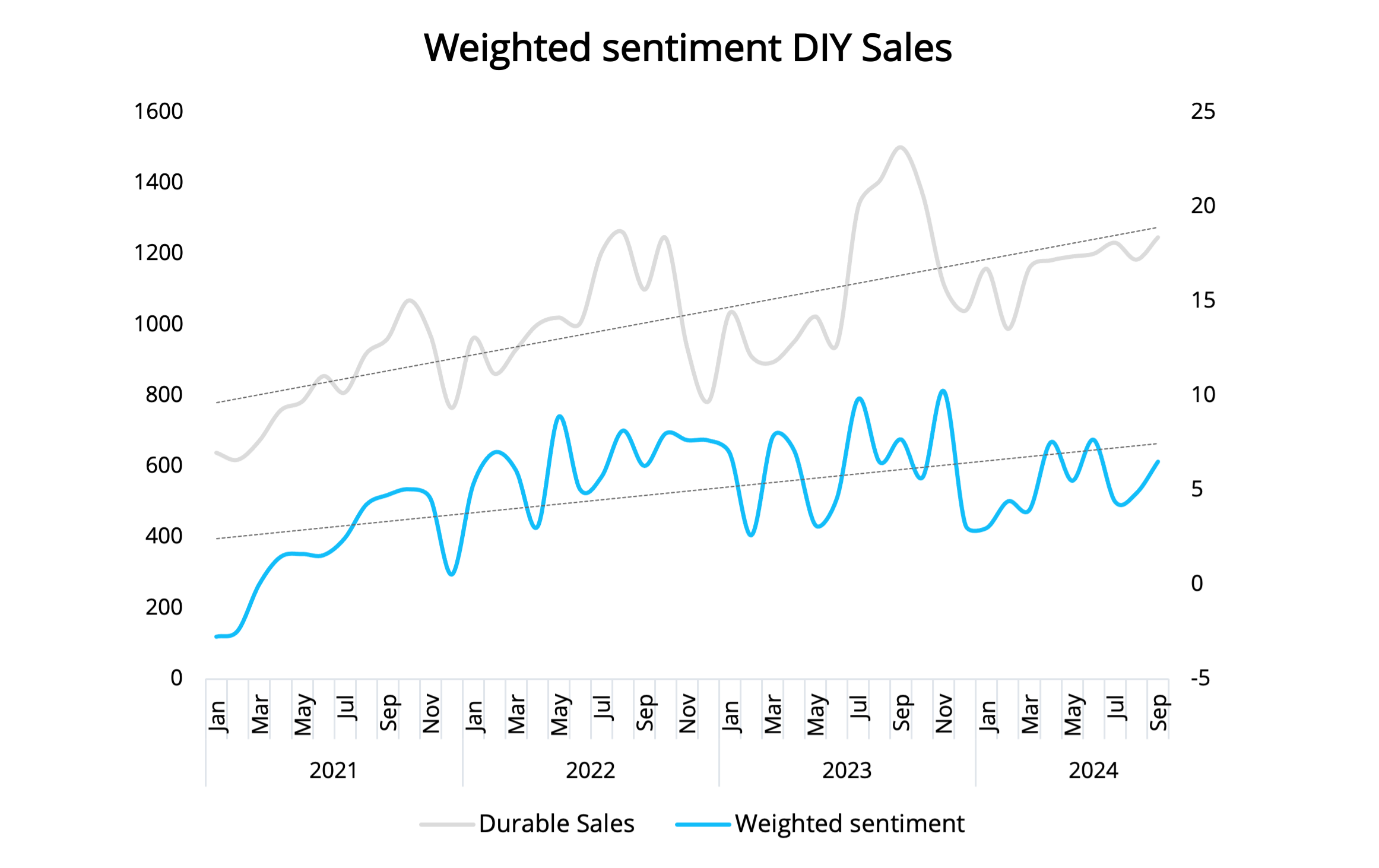

3. Weighted sentiment predicts DIY sales

DIYers post their problems and solutions in real time. Brands that are mentioned as helpful, reliable, or simply visible in those solutions come out on the winning side. For a leading U.S. durable brand, we found that rising positive weighted sentiment is followed by higher sales the next month. This confirms that sentiment isn’t just about perception; it’s a powerful early signal of commercial growth.

These cases also highlight an essential yet often overlooked dynamic in social media analysis: the ad stock effect. The ad stock effect is a media & econometrics concept that describes how the impact of advertising doesn’t occur all at once but builds up and decays gradually over time. Each exposure to a campaign or message contributes to a “stock” of brand awareness or preference that persists even after the advertising has stopped.

Just like paid media, the impact of UGC doesn’t vanish once the conversation ends. Instead, it accumulates over time, influencing consumer perceptions, brand salience, and even sales well beyond the initial moment of exposure. Positive sentiment, when sustained, builds a “stock” of mental availability, reinforcing the brand’s presence in the consumer’s mind.

If we look only at social data in real-time spikes, we miss the long-tail value of consistent, earned conversation. For marketers and insights teams, factoring in the ad stock effect turns social listening from a short-term buzz metric into a strategic tool for long-term brand equity building and commercial forecasting.

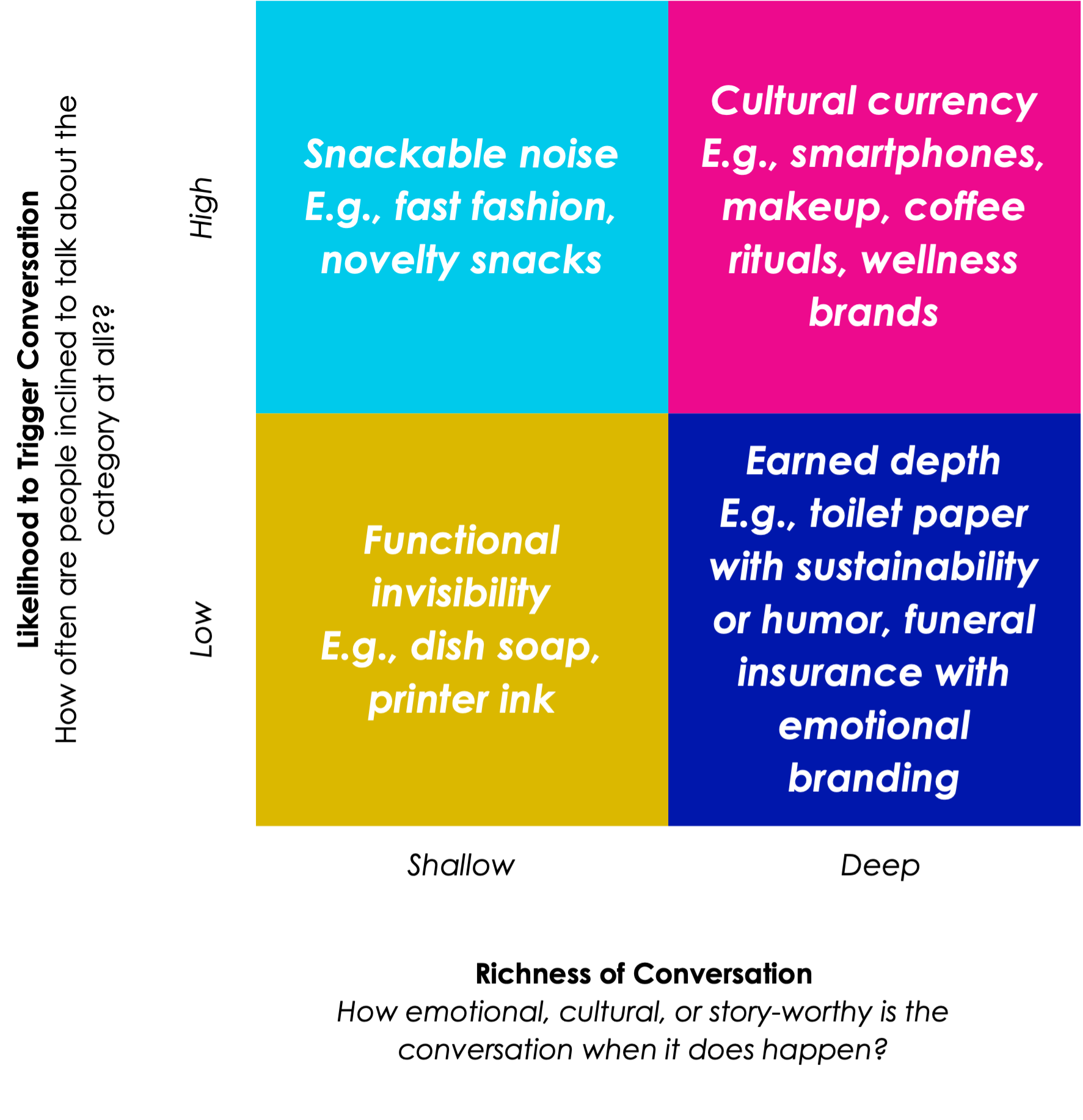

Talkability: brands that spark buzz

Talkability is the likelihood of a brand or category being talked about, and the richness, emotional charge, or cultural relevance of how it’s talked about. It may be one of the hidden levers determining whether user-generated talk actually moves the needle on brand performance.

- Some categories (e.g. beauty, tech, food) naturally spark conversation. People love to share, show, review, and discuss them.

- Other categories (toilet paper, cleaning products, insurance) may not seem talkable at first but can get people talking when brands tap into humor, sustainability, or cultural narratives.

Few categories are talkable by default. For the ones that aren’t, brands have to earn it. Even if your category is unglamorous or low-profile, the right creative angle can spark conversation and build brand equity.

Rethinking the old rules of representation

A commonly echoed critique of UGC is that it isn’t representative. But here’s what such arguments fail to account for:

- UGC isn’t representative, but it is reflective of cultural relevance, emotional engagement, and what matters to consumers.

- Influence matters more than incidence. The most shared voices are often the ones that shape brand narratives. UGC captures not only sentiment but momentum.

- UGC doesn’t replace surveys; it complements them. One gives you structure, while the other gives you context and speed.

- Social media is now mainstream. Every demographic participates in digital expression to some extent. With proper data hygiene, we can extract meaningful insights even from noisy data.

On the flip side, when you start treating UGC as a legitimate brand metric, you gain:

- New levers to pull: Want to impact consideration fast? A viral moment can do more than a six-week media plan.

- Early warning signals: Spot brand sentiment shifts before they show up in trackers.

- Real-time campaign feedback: Know if your brand film is being quoted, parodied, or forgotten – today, not next quarter.

- More holistic brand equity: See how earned, owned, and paid media interact in the wild (not just in media plans!)

Social data has rules

Before we crown UGC the new king of brand metrics, we must respect its complexity:

- Cleanliness is everything. Noisy data is dangerous – spam, (fake) AI-generated content, bots, and irrelevant mentions need to be filtered out. Not all chatter counts.

- Negativity (or positivity) needs nuance. One bad review isn’t a trend. But five, in the same context, probably are.

- Old posts still echo. A viral hit from 2021 might still shape your brand’s perception today. The “stock” effect is real.

- Topic matters. What people talk about is as important as how much they talk about it. Moderation and framing are key.

- Paid vs. organic: know what’s truly earned. Organic love is gold. Paid buzz is rented attention.

- Combining data from different platforms is messy. Each platform has a unique culture, vocabulary, and metrics. Stitching them into one coherent picture is a challenge in itself.

What Bob Marley can teach us about brand metrics

Like insights, music is rarely created from a single note. Consider Bob Marley’s Three Little Birds. The power of the song doesn’t lie in the melody, rhythm, or the vocal alone; it lies in the harmony between all three. It’s the way different sounds come together: distinct and complementary.

Market research should strive for the same kind of harmony. Survey data and social media data are like melody and rhythm. On their own, they’re useful, but when combined, they create something far richer and more powerful.

UGC may not be perfect, but it is powerful. With the right metrics, it can unlock new dimensions in brand tracking.

Download the full white paper here.

About Toluna

Toluna is the leading global research and insights provider that empowers clients to make smarter data-driven decisions. For 25 years, we’ve partnered with our clients to deliver greater business impact through our advanced platform, end-to-end solution portfolio, deep industry expertise, and expansive global first-party panel. From DIY to full-service consultancy, our unique approach can be tailored to fit any time, budget, and resourcing needs.

From creative testing to brand tracking, and from packaging optimization to e-commerce understanding, Toluna’s range of solution suites provide brands with the insights required to drive growth, relevance, and profitability.

With over 40 offices across the globe, we deliver research in 70+ countries to the world’s leading brands. Recognized as a top innovative company by GRIT in 2024, we are at the forefront of insights innovation and excellence.

www.tolunacorporate.com