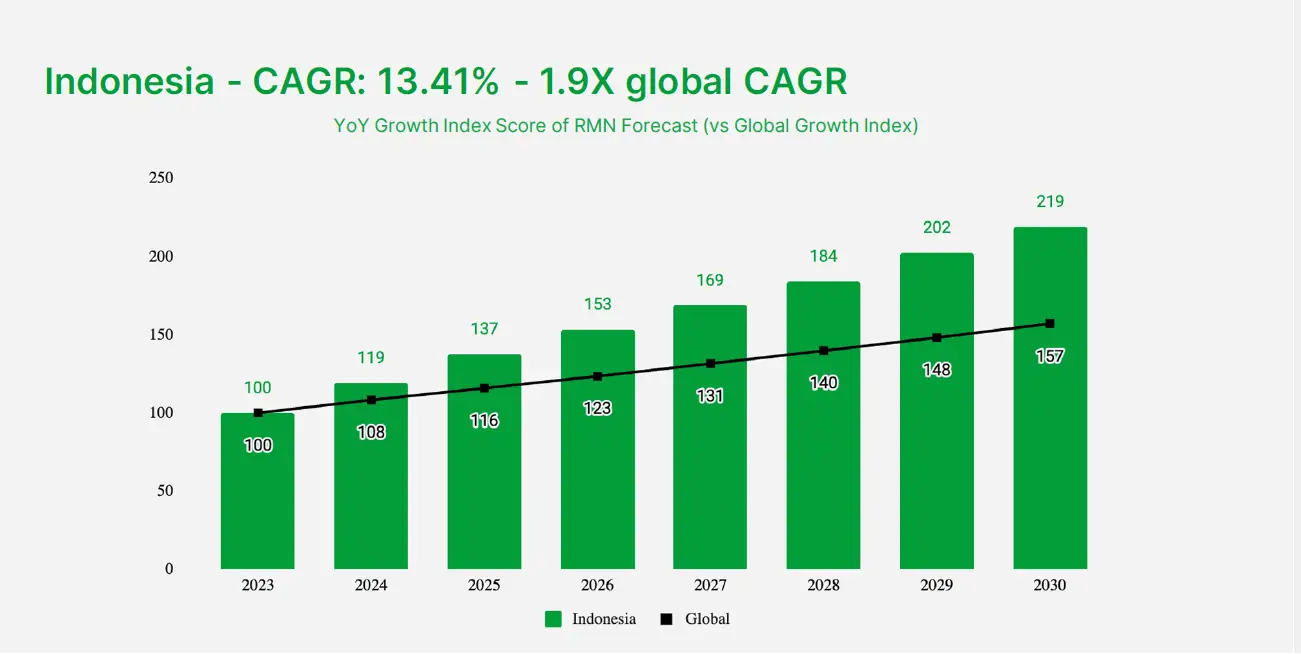

- Indonesia will lead the pack in SEA with a projected 13.41% Compound Annual Growth Rate (CAGR) in RMN ad spend.

- Southeast Asia’s total ad spend in retail media networks this year to grow by 8% YoY, projected to hit US$4.7 billion by 2030

- Grab becomes the super-app with the highest ad equity in Indonesia

Retail media networks (RMNs) are shown to be a significant advertising channel by marketers in Indonesia, with the highest projected CAGR (Compound Annual Growth Rate) in Southeast Asia. Ad spend on RMNs in Indonesia is expected to surge by 219% from 2023 to 2030, reflecting a CAGR of 13.41%. This is 1.9 times higher than the projected global growth rate, underlining the increasing importance of RMNs as a key advertising channel for brands in Indonesia (See Figure I below).

Figure I: Indonesia and global forecasted year-on-year (YoY) growth in RMN ad spend from 2023 to 2030, Grab Internal Data

The data above is based on the latest study by GrabAds, the advertising arm of Southeast Asian superapp Grab, and Kantar, one of the world’s leading media insights and research for advertising. Globally, RMN ad spend is expected to surge by 73% in the next seven years, surpassing growth rates in search (47%) and social (45%).

Retail Media Networks are retail ecosystems that leverage first-party transaction data to personalise ads, target audiences, and deliver full-funnel impact for advertisers, while enabling closed-loop measurements. RMNs leverage unique customer data to close the advertising loop, enhancing advertisers’ ability to target and measure ad effectiveness directly at the point of purchase.[1]

GrabAds and Kantar believe Southeast Asian marketers will prioritise investments towards RMN channels this year, with year-on-year ad spend growth projected to increase from 8% in 2024 to 11 % in 2030.[2] This upward trend is unsurprising as RMNs ranked first in ad equity across different media channels in the Kantar Media Reactions 2022 study. Ad equity measures how receptive consumers are to advertising messages, with campaigns proving to be 7 times more effective on channels which have positive ad equity. This is evident with Grab leading the way as the superapp with the highest ad equity in the country.[3]

“RMNs allow marketers to serve highly relevant ads to consumers by showcasing products and brands that cater to their immediate needs and behaviour across the buying journey. This approach to advertising adds value to consumers rather than disrupting the browsing experience. Keeping up with consumer habits and behaviour is the only way for brands to be meaningfully different, and we at Kantar believe that RMNs, with first-party data informed by real consumer transactions, can give brands the tools they need to provide greater value for consumers and build strong brand differentiation.” ⸺ Katie McClintock, Regional Managing Director, Kantar.

Superapps drive overall RMN growth with the ability to reach the hybrid shopper

Unlike the other RMN types that cover specific purchase stages, superapp RMNs can reach consumers at all stages of their buying journey, from awareness to purchase. This includes offline and online touchpoints, which are becoming increasingly key as shopping evolves into an omnichannel experience. Per the study, 79% of Southeast Asian shoppers use both online and offline channels[4] and using both channels improves positive ad receptivity by 5%.[5]

The increasing share of RMNs in marketers’ media mix over the next 7 years is also propelled by the unique market dynamics in Southeast Asia. The GrabAds and Kantar study highlights that 2 out of 3 Southeast Asians find it important to have products and services on demand.[6] 61% also shared that it is very important to have products or services to anticipate their needs, compared to the global figure of 52%.[7] This suggests that Southeast Asian consumers prefer seamless, convenient transactions that fulfil their needs quickly. Superapp RMNs are well-positioned to serve these consumer needs with their O2O full-funnel ecosystem powered by first-party data.

The latest Food and Groceries Trends Report 2023 released by GrabAds in Indonesia also revealed that 9 out of 10[8] users surveyed said they prefer restaurants with integrated online-to-offline or omnichannel (O2O) experiences, indicating that consumer demands by these digitally-savvy individuals are paving the way for RMNs to flourish in Indonesia.

“Grab, as a leading Southeast Asian superapp, demonstrates how its leading advertising solution, GrabAds, empowers brands to deliver targeted advertising at every touchpoint to Indonesian consumers, who are increasingly seeking a seamless blend of online and offline shopping experiences. This tailored approach is crucial for brands aiming to keep pace with the high mobile engagement and the convenience-driven shopping behaviour prevalent in the country,” ⸺ Roy Nugroho, Director of Grab For Business (GFB) at Grab Indonesia.

Ad spend growth on RMNs in each of the Southeast Asian countries is projected to grow higher than the global growth index, with Indonesia leading the pack. The growth of RMNs in Indonesia truly shows how marketers in the country regard RMNs as an effective digital marketing channel to grow their brand and drive sales. On the consumer side, RMNs have high ad equity value, showing how consumers regard it as a relevant and credible channel.

[1] McKinsey. Six secrets of unleashing the power of retail media. May 18, 2023.

[2] Kantar Media Reactions study 2022

[3] Kantar. Kantar Media Reactions 2023: Braving the battleground.

[4] WGSN, Phygital—a cross of the words physical and digital.

[5] Ibid.

[6] Kantar Global Monitor 2022

[7] Ibid.

[8] Grab survey August 2023, n=1,069 active Grab ID users