Health as a New Growth Engine

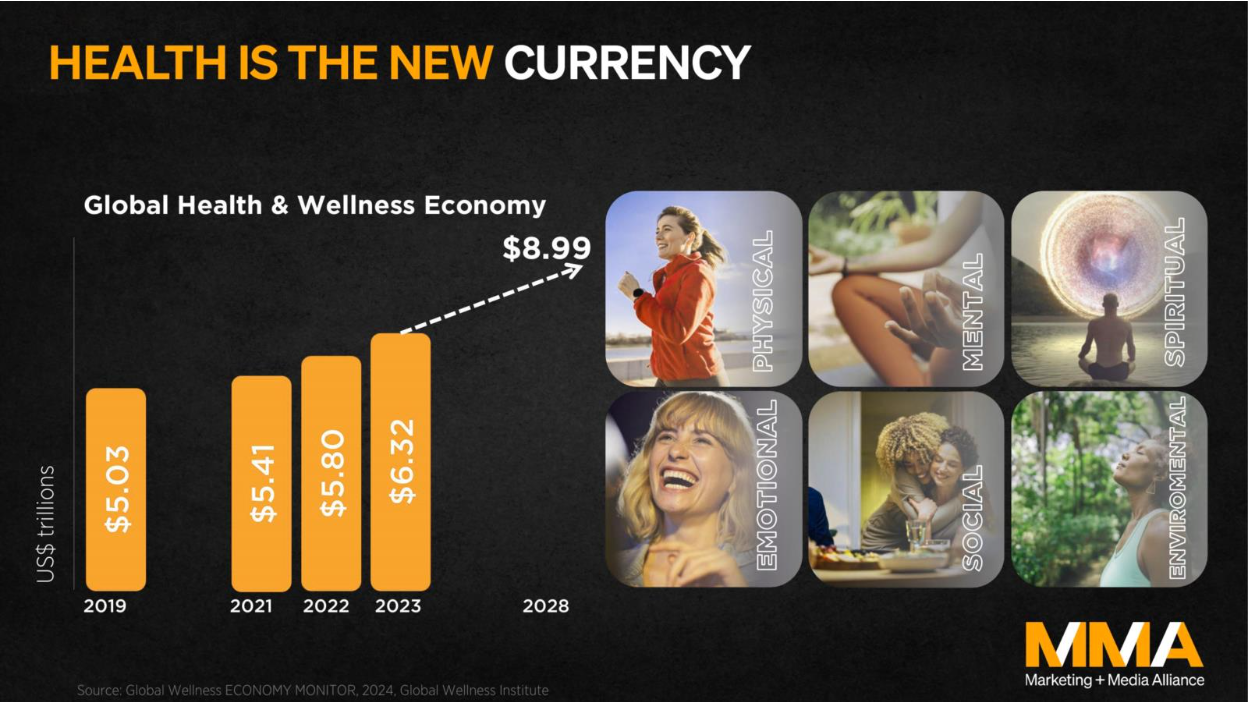

The global health and wellness economy has moved beyond being a short-term trend to become a structural shift in how consumers define value and make purchasing decisions. According to the Global Wellness Economy Monitor 2024 by the Global Wellness Institute, the market expanded from USD 5.03 trillion in 2019 to USD 6.32 trillion in 2023 and is projected to reach USD 8.99 trillion by 2028.

This growth is fueled by a convergence of long-term forces: heightened post-pandemic health awareness, the rapid expansion of fitness culture, the widespread adoption of digital health tools, and the rising purchasing power of Gen Z and Millennials, who increasingly view wellness as a lifestyle rather than a luxury. As Mr. Tạ Minh Hải, Marketing Director – Health & Wellness Category at Suntory PepsiCo Vietnam, noted, “Health has become a new form of currency, and consumers are spending it every day through their choices.”

From Global Shift to Vietnam Reality

In Vietnam, this global shift is already translating into tangible changes across the FMCG landscape. In 2024, 36% of consumers rank health and wellness as their top priority, 80% exercise at least once a week, and 46% actively use mobile apps to track their health (Source: NIQ Consumer Expectations 2024; Euromonitor, Consumer Lifestyle & Value, Vietnam, 2024).

More importantly, wellness is no longer limited to major cities or affluent consumer segments. Instead, it is spreading across regions and demographics, creating large-scale opportunities for FMCG brands to innovate across beverages, nutrition, and lifestyle categories.

Reinventing FMCG: Function, Purpose, and Personalization

As consumer expectations evolve, FMCG brands are being forced to rethink categories traditionally associated with indulgence. With 48% of consumers reducing high-sugar intake and 37% avoiding processed foods, global and local players alike are redefining their portfolios.

At the same time, functionality has emerged as the new product standard. According to the ADM “Relaxing, Celebrating, or Rehydrating” 2024 Report, consumers increasingly seek benefits such as hydration, cognitive support, relaxation, digestive health, and energy. Hydration+ categories, in particular, are forecasted to grow the fastest, signaling the rise of products that integrate physical performance with mental refreshment.

This evolution is further amplified by advances in health technology. Today, 64% of global consumers expect personalized nutrition and tailored health products (Source: Innova Market Survey). Innovations such as Gatorade’s Sweat Patch and AI-powered Hydration Coach demonstrate how FMCG brands can combine data, wearables, and artificial intelligence to deliver personalized guidance at scale. In Vietnam, growing adoption of smart devices and health apps is likely to accelerate this shift toward hyper-personalized wellness.

Mental Wellness: The Next Competitive Frontier

While physical health has long been the focus, mental wellness is rapidly emerging as the next competitive frontier. The Who Cares? Who Does? Health Survey by Kantar Worldpanel and YouGov reveals that 61% of people globally identify stress as the biggest barrier to becoming healthier.

This insight is reshaping how brands communicate relevance and care. As shared by Mr. Tạ Minh Hải at MMA INNOVATE Vietnam 2025, PepsiCo’s Tropicana (Twister in Vietnam) has successfully linked gut health with mental well-being, supported by research showing that 60% of UK consumers believe gut health directly impacts mental health. In Vietnam, this mindset is gaining momentum: 56% of consumers seek products that help them feel good both mentally and physically, and 49% believe brands should actively help them live healthier lives.

What This Means for FMCG Brands

To capture this shift, Mr. Hải highlighted three strategic imperatives for FMCG brands:

- Right Offering: Design products that address multidimensional needs while balancing functionality and enjoyment.

- Build Trust through Purposeful Storytelling: Connect brand values with both functional and emotional well-being, earning trust through authenticity.

- Influence Culture through Partnerships: Collaborate with fitness, healthcare, and technology ecosystems to scale innovation and impact.

Together, these principles enable brands to evolve from product providers into partners in healthier living.

Ultimately, the health and wellness economy is not just reshaping what consumers buy—it is redefining the role of FMCG marketing itself. The next wave of growth will belong to brands that successfully blend science with empathy, technology with humanity, and profit with purpose. As Mr. Hải concluded, “Consumers don’t just want healthier options—they want brands that help them live better.”